The secrets to dealing with a passive aggressive team member

Managing a successful team involves getting the best out of different personalities and helping...

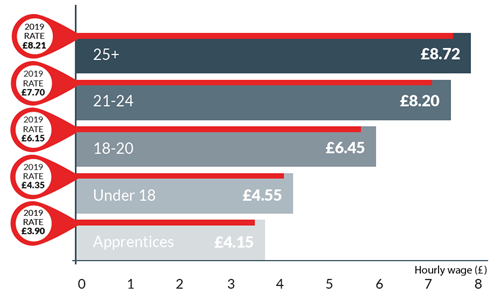

From 1st April 2020, the National Minimum Wage (NMW) and National Living Wage (NLW) rates will increase, impacting both workers and employers.

The NMW is the minimum pay per hour workers are entitled to by law. The rate depends largely on a worker’s age and if they are an apprentice. If you’re above 25, you qualify for NLW instead.

Employers failing to meet the rate will be fined and potentially featured in the annual list of shame, so ensure you evaluate finances before this comes into effect. Furthermore, it’s also worth checking you are including all the activities that count as working time, e.g. travelling between appointments, waiting to start a job and training.

Minimum wages are worked out as hourly rates but apply to workers even if not paid by the hour. If you pay annually, monthly or for piece work, for example, you will need to work out the equivalent hourly rate to see if you’re meeting legal minimums.

You can see the new rates detailed in the table below, but you can check out full details on the Government’s own website.

Alternatively, you can speak to your HR GO consultant and they will be able to give you information on the matter.

Managing a successful team involves getting the best out of different personalities and helping...

Chances are, you’re one of the 364 million people who have a profile on the business networking...