The secrets to dealing with a passive aggressive team member

Managing a successful team involves getting the best out of different personalities and helping...

From 1st April 2023 the National Living wage, and the National Minimum Wage rates are increasing. And that affects most businesses in the UK.

The National Minimum Wage is the minimum pay per hour almost all workers in the UK are entitled to. The National Living Wage is higher than the National Minimum Wage - workers get it if they’re 23 or over.

Irrespective of the size of business, or the work being performed, employers are required by law to pay the correct minimum wage. There are exceptions as we explain below, but these only apply in a few cases.

The National Minimum Wage was introduced in 1998 to ensure that all workers in the UK earned at least a minimum wage for their efforts. Each year the Low Pay Commission recommend minimum wage rates, and changes are introduced each April. With inflation running at very high levels this year’s increases are significant.

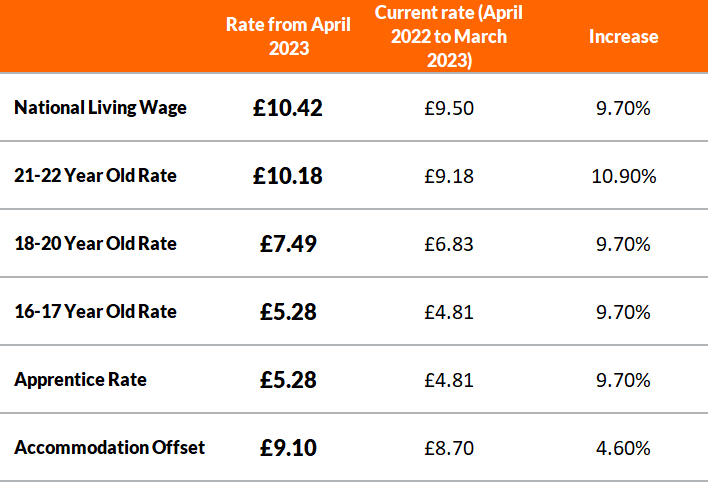

From 1st April 2023 the rates are changing.

From that date the National Living Wage for anyone aged 23 and over rises from £9.50 to £10.42. That’s an increase of 9.7 % and reflects the rate of inflation and cost of living pressures. The rate for people aged 22 and under is also changing.

Rate from April 2023

What if I use temporary workers?

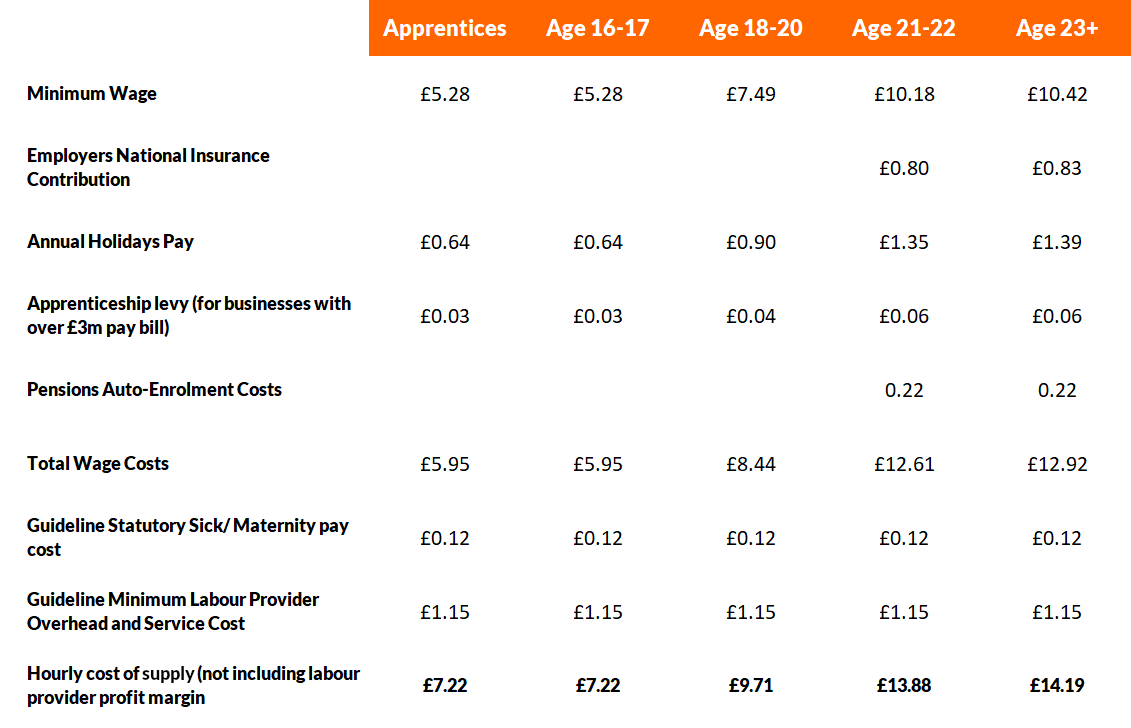

The changes apply to all workers, whether temporary workers or permanent employees. But if you use temporary workers then you’ll also see some changes in the costs from your recruitment agency. That’s because the rates affect how much you’ll pay when overheads like national insurance, holiday entitlement, apprenticeship levy and pensions contributions are taken into consideration.

The Gangmasters and Labour Abuse Authority has issued guidance on the likely minimum hourly charge rates that will take effect from 1st April.

From 1st April you should expect to pay at least £14.19 per hour plus whatever your recruitment agency charges for temporary workers.

In the devolved nations the calculation is slightly different but costs are similar for Scotland and Northern Ireland, and in Wales the figure is £14.26.

So my costs are going to increase, right?

In short, yes.

When the new rates were proposed the Government recognised that businesses would have a cost increase. Businesses now have to decide whether to absorb this cost, increase prices, or find savings in other ways.

And that’s why it might be a good time to consider how you can save costs elsewhere. Business have to pay the NMW – you can’t simply ignore the increase. Failure to do so would mean you were breaking the laws and leave you at risk of a significant fine. Plus it reflects very badly on your business. In 2020 almost 200 firms were found to have underpaid workers, and were fined as a result. And a quick search online will tell you who they were – the bad news is still there and affects their reputation as employers – that’s really important in the current labour shortage.

At HR GO we help clients save on employment costs in several ways. For our managed service clients we look after all aspects of managing temporary workers – from onboarding and training to payroll, time and attendance and conduct matters. That saves our clients time and money whilst still ensuring that workers are fairly paid.

If you're already an HR GO client then our team will be in touch to talk you through how we're managing the change in National Minimum Wage and National Living Wage

And if you want to know more about our managed services, or how we can save you money please get in touch - email us at Enquiries@hrgo.co.uk or fill in the form below.

Managing a successful team involves getting the best out of different personalities and helping...

Chances are, you’re one of the 364 million people who have a profile on the business networking...